It is not clear if this actually improves the performance of a a stock portfolio, but perhaps investors sleep better using this approach ...

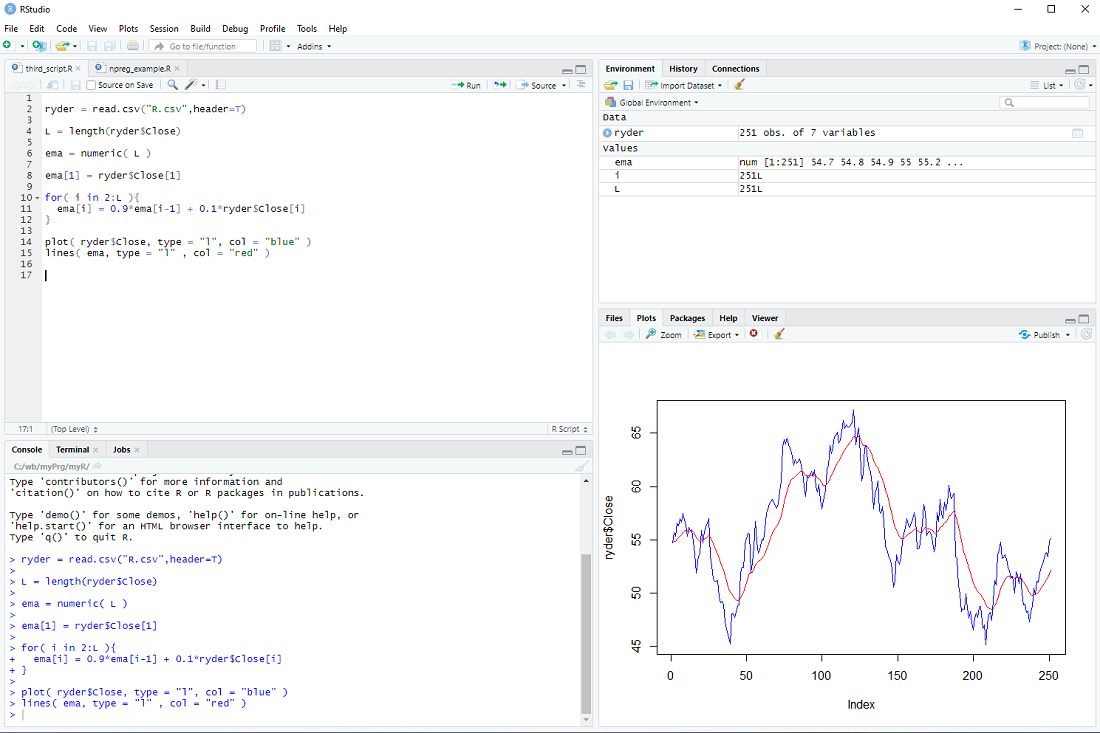

There is no "exponential moving average" procedure in the R base package, but it can be easily calculated with a for-loop.

After loading the stock data file

ryder = read.csv("R.csv",header=T)

L = length(ryder$Close)

we create the vector ema

ema = numeric( L )

We set the first element of ema to the first close price

ema[1] = ryder$Close[1]

and then we calculate

ema[2] = 0.9*ema[1] + 0.1*ryder$[2]

ema[3] = 0.9*ema[2] + 0.1*ryder$[3]

.

.

.

in a loop:

for( i in 2:L ){

ema[i] = 0.9*ema[i-1] + 0.1*ryder$Close[i]

}

Finally, we display the prices and ema

plot( ryder$Close, type = "l", col = "blue" )

lines( ema, type = "l" , col = "red" )

At this point most tutorials would emphasize that R is an interpreted language and for-loops should be avoided at all costs.

Indeed one should use vector operations whenever possible instead of the element-by-element processing in a for loop.

However, microprocessors are so fast nowadays, that for-loops are problematic only for really large data sets imho.

exercise: Repeat the calculation, but with the volume instead of the price.

No comments:

Post a Comment